Most people think wealth is a function of income.

It isn’t.

Wealth is a function of control—specifically, control over when you do things. Time flexibility quietly shapes how much you spend, how much energy you have, and how many good financial decisions you’re able to make.

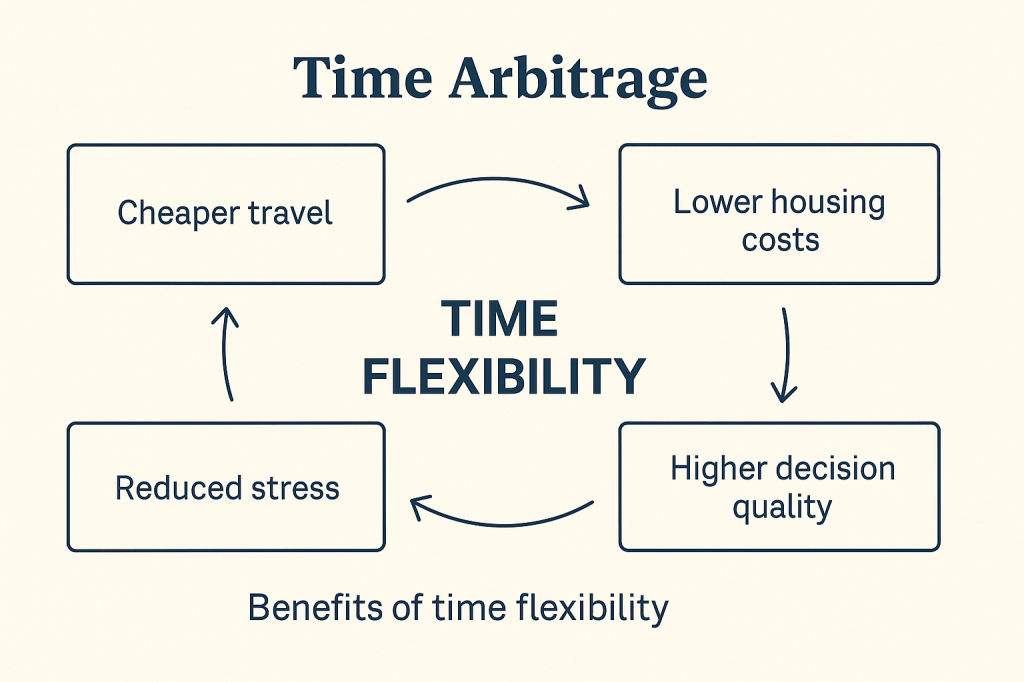

This is time arbitrage.

It’s not about working more hours or hustling harder. It’s about using flexibility to buy the same things—housing, travel, health, food, learning—at a lower cost and with higher quality.

And once you see it, you can’t unsee it.

What Is Time Arbitrage?

Time arbitrage is the practice of using schedule flexibility to reduce costs and increase value.

When you’re not locked into fixed hours, fixed locations, or peak demand windows, you gain access to:

- Cheaper prices

- Better options

- Lower stress

- Higher decision quality

Most people are forced to transact during the most expensive, crowded, and inefficient times. Not because they want to – but because their schedule leaves them no choice.

Time arbitrage flips that constraint.

Why Time Flexibility Is a Financial Asset

Money is visible. Time isn’t.

That’s why time flexibility is undervalued – despite being one of the strongest multipliers of financial efficiency.

Consider two people with identical incomes:

- One works fixed hours, fixed location

- The other controls when and where they work

Over a decade, their financial trajectories diverge dramatically – not due to income, but due to cost structure.

Flexibility reduces spending across almost every category.

Where Time Arbitrage Saves You Real Money

1. Travel Costs Drop Immediately

Flexible schedules unlock:

- Off-peak flights

- Midweek accommodations

- Shoulder-season pricing

A flight that costs $900 on a Friday might cost $450 on a Tuesday. Hotels often drop 30–50% outside peak windows.

This isn’t a hack. It’s basic supply and demand—applied through time.

Over years, this alone saves tens of thousands.

2. Housing Becomes Negotiable

Fixed schedules force you into:

- Expensive cities

- Peak rental markets

- Long commutes

Flexible time allows:

- Living slightly outside demand centers

- Moving during off-season rental cycles

- Geoarbitrage (earning in strong currencies, spending in cheaper locations)

Housing is most people’s biggest expense. Time arbitrage directly attacks it.

3. Food and Health Costs Quietly Shrink

Time-constrained people outsource everything:

- Takeout instead of cooking

- Convenience over quality

- Reactive healthcare instead of preventive care

Flexibility allows:

- Home-cooked meals

- Training during non-peak gym hours

- Sleep aligned with your physiology, not your alarm

Health compounds financially. Fewer injuries, fewer illnesses, higher energy, better focus.

That’s money you don’t see – but keep.

4. Energy Improves Decision Quality

Poor financial decisions often come from:

- Fatigue

- Rushed thinking

- Cognitive overload

Time flexibility creates space:

- To compare options

- To delay impulse purchases

- To think clearly

This is subtle but powerful. One avoided bad decision often outweighs months of optimization elsewhere.

Time Arbitrage and FIRE

FIRE (Financial Independence, retire Early) discussions obsess over:

- Savings rate

- Investment returns

- Withdrawal rules

All important – but incomplete.

Time arbitrage accelerates FIRE by:

- Lowering your required annual spend

- Increasing lifestyle quality at the same cost

- Reducing burnout (which derails FIRE plans more than market crashes)

A lower cost, higher-quality life needs less money to sustain. That’s leverage.

How to Build Time Arbitrage Into Your Life

This isn’t all-or-nothing. You don’t need full freedom to benefit.

1. Negotiate Time, Not Money

Ask for:

- Flexible start/end times

- Remote days

- Output-based evaluation

These often cost employers nothing and are easier to approve than raises.

2. Batch Life Logistics

Handle:

- Errands

- Appointments

- Travel planning

During low-demand hours. Less waiting. Less stress. Better prices.

3. Design for Optionality

Choose:

- Roles with asynchronous work

- Skills that aren’t location-dependent

- Income streams decoupled from hours

Optionality is time arbitrage’s foundation.

4. Shift One Expense Category First

Start where payoff is biggest:

- Housing

- Travel

- Food

- Health

Even partial flexibility creates immediate returns.

The Hidden Compounding Effect

Time arbitrage compounds in three ways:

- Financially – lower costs, higher savings

- Physically – better health, more energy

- Cognitively – better decisions over time

These reinforce each other.

More energy → better work

Better work → more leverage

More leverage → more time control

That’s a flywheel worth building.

Common Misconceptions

- “This only works for remote workers.”

False. Even small schedule shifts matter. - “I need to earn less for flexibility.”

Often the opposite. High-leverage roles value output, not hours. - “I’ll optimize later.”

Time arbitrage works best when started early – it compounds quietly.

Final Thought

Time isn’t just money.

Time is price access.

The more control you have over when you act, the less you pay and the better your life becomes – without earning more or sacrificing comfort.

Time arbitrage turns flexibility into a financial asset.

And once you start using it, everything gets cheaper.

Leave a comment