Most advice about money stress points in the same direction: earn more.

Higher income is presented as the universal solution—to anxiety, insecurity, and the feeling that you’re always one unexpected expense away from trouble.

Sometimes that’s true. Often, it isn’t.

Plenty of high earners feel financially fragile. Meanwhile, some moderate earners sleep well, feel in control, and experience money as a tool rather than a constant pressure.

The difference isn’t income. It’s lifestyle beta.

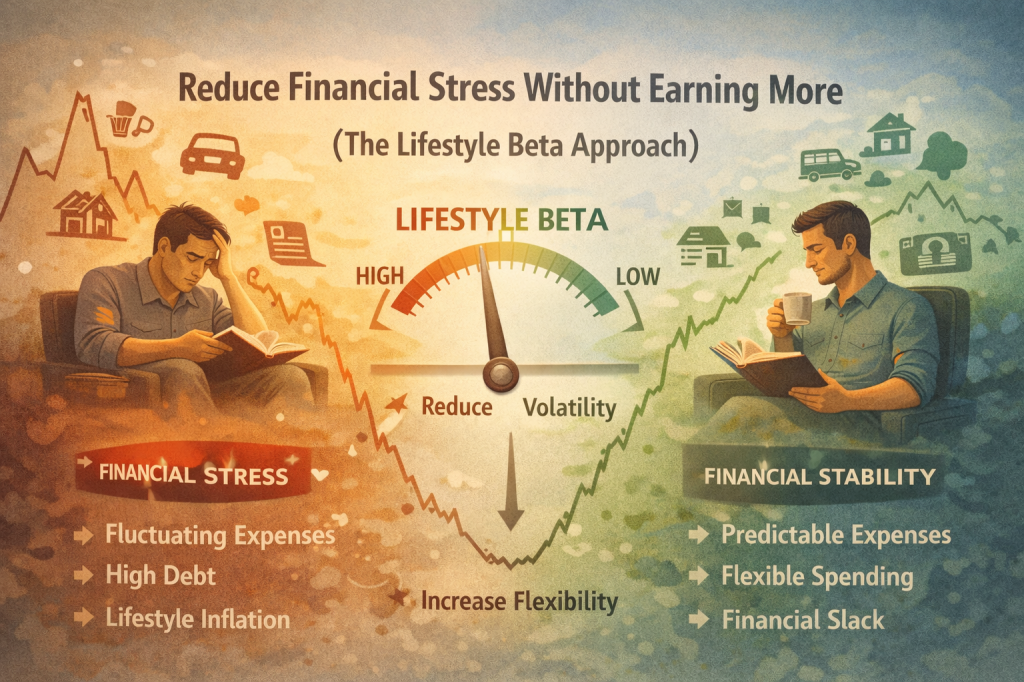

This post introduces the idea of lifestyle beta—how sensitive your life is to financial shocks—and shows how lowering it can reduce financial stress faster and more reliably than earning more money.

Why Income Alone Doesn’t Fix Financial Stress

If income solved money anxiety, stress would decline linearly as earnings rise.

In reality, stress often plateaus—or returns.

That’s because expenses, expectations, and identity scale with income. This dynamic is at the heart of Lifestyle Inflation Detox and Future-Proofing Your Lifestyle, where spending quietly expands to absorb every raise.

More income increases capacity—but often increases exposure.

You end up running faster on a wider treadmill.

Introducing Lifestyle Beta

In finance, beta measures how volatile an investment is relative to the market.

A high-beta stock amplifies market swings. A low-beta asset moves more steadily.

Your lifestyle has a beta too.

Lifestyle beta measures how strongly your quality of life reacts to income fluctuations, expenses, and external shocks.

- High lifestyle beta → small disruptions create large stress

- Low lifestyle beta → disruptions are absorbed with minimal impact

Financial calm comes less from how much you earn—and more from how stable your system is.

The Hidden Cost of a High-Beta Lifestyle

High lifestyle beta shows up as:

- Fixed costs that are hard to reduce

- Commitments that require constant income

- Little room for error

- Anxiety around job security

This is why FIRE (Financial Independence, Retire Early) without slack is fragile, as explored in Why FIRE Isn’t Sustainable Without Financial Slack.

A brittle lifestyle demands certainty in a world that doesn’t offer it.

Why Earning More Can Increase Stress

Paradoxically, higher income often raises lifestyle beta:

- Bigger homes → higher fixed expenses

- Nicer neighborhoods → social spending pressure

- Specialized jobs → less flexibility

Income rises, but optionality shrinks.

This mirrors the pattern described in Expense Ratios for Life: efficiency gains compound only until they create new constraints.

The Core Principle: Lower Beta Before Chasing Alpha

In investing, prudent portfolios reduce downside risk before seeking upside.

The same applies to life design.

Lowering lifestyle beta:

- Reduces stress immediately

- Improves resilience

- Increases optionality

Only then does higher income meaningfully improve well-being.

How to Identify Your Lifestyle Beta

Ask yourself:

- How many months could I cover expenses if income stopped?

- Which costs are fixed vs flexible?

- How quickly could I downshift if needed?

- How much of my spending supports my values vs my identity?

If these questions feel uncomfortable, that discomfort is signal.

Lowering Lifestyle Beta Without Deprivation

Reducing beta isn’t about austerity. It’s about design.

1. Convert Fixed Costs to Variable Ones

High fixed costs increase fragility.

Examples:

- Smaller or more flexible housing

- Fewer long-term subscriptions

- Location choices that reduce baseline expenses

This aligns with Geographic Flexibility as Wealth and Geoarbitrage 101, where flexibility itself becomes a financial asset.

2. Build Financial Slack

Slack absorbs shocks.

Emergency funds, conservative withdrawal assumptions, and margin in monthly budgets matter more than aggressive optimization.

This theme runs through Financial Independence Without Extremes and The Psychology of Enough.

Slack reduces cognitive load.

3. Reduce Identity-Coupled Spending

Some expenses feel non-negotiable because they’re tied to who you think you are.

Cars, housing, travel, even productivity tools can become identity anchors.

Detaching self-worth from spending lowers beta instantly.

4. Design for Downshifts

A resilient lifestyle works at multiple income levels.

Ask:

- Could this lifestyle function at 70% income?

- At 50%?

Designing for graceful downshifts mirrors Lifestyle Prototyping — testing alternatives before you’re forced to adopt them.

The Emotional Side of Financial Stress

Money stress is rarely about numbers alone.

It’s about:

- Loss of control

- Fear of regression

- Status anxiety

Lower lifestyle beta reduces emotional volatility by restoring agency.

This reframes FIRE as optionality, not escape—an idea central to The Optionality Playbook.

Lifestyle Beta vs Extreme Frugality

Lower beta doesn’t mean extreme frugality.

In fact, hyper-frugality can increase stress if it removes joy or creates constant vigilance. This tradeoff appears in The second-order effects of frugality.

The goal isn’t to spend less—it’s to suffer less from spending changes.

Why Low Lifestyle Beta Feels Like Wealth

When your expenses are flexible and your needs modest:

- Raises feel optional

- Job changes feel survivable

- Market volatility feels distant

This is why many people reach FIRE-like peace before hitting a FIRE number, as discussed in Financial Independence Is a Skill, Not a Number.

A Simple Lifestyle Beta Audit

Once a year, review:

- Fixed vs variable expenses

- Commitments longer than 12 months

- Expenses tied to status or identity

- Your minimum viable monthly spend

Track beta, not just net worth.

Final Thought

You don’t need to earn more to feel financially secure.

You need a lifestyle that doesn’t amplify uncertainty.

Lowering lifestyle beta turns money from a source of stress into a stabilizer.

Income helps—but resilience lasts.

Design for calm first. The rest compounds naturally.

Leave a comment